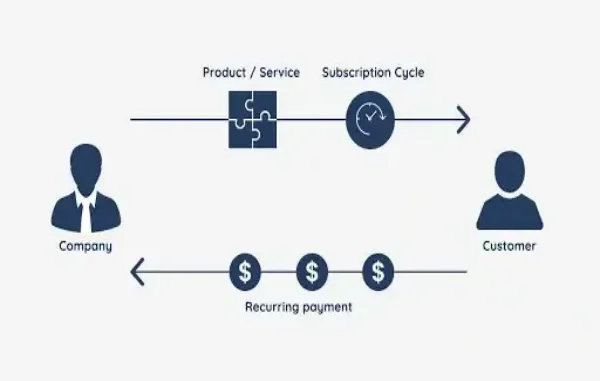

Subscription models have dominated the modern era, with it almost completely replacing once-off purchases. When you tally up your digital services, how many of them can you confidently say do not require (or at least offer) a subscription plan? For customers, these subscriptions are very convenient and provide uninterrupted access, but how do they benefit businesses? There are a few ways it can prove advantageous, but with “subscription fatigue” becoming an increasingly larger issue, it raises a valid point: are subscription models still a winning strategy?

The Commitment Economy: iGaming As A Case Study

Many modern businesses have adopted subscription models, with it expanding beyond just content and software, even impacting the entertainment sector. More specifically, there seems to have been a shift in iGaming, with platforms seeing more operators play with the idea of providing tiered access to their sites or apps. The motivation behind this decision comes from the potential of monetizing long-term engagement instead of just offering basic access. In the UK, for example, there are an array of physical casinos that provide memberships/subscription services to their customers.

Many of these allow members special discounts on drinks and food, bonus points when gambling, and even cashback rewards. As a result, it brings in more customers and helps to build a loyal, recurring consumer base. In comparison, Singapore-based online casinos currently offer players an impressive selection of cash games, promotional offers, and the best poker rooms, all for free. Many offshore and locals want to play poker in Singapore casinos, meaning these operators could make a large profit through offering memberships or VIP programmes. These could offer players a free version of the poker platform, then add tiers that can provide access to exclusive high-stakes rewards or even bonus packages or virtual currency boosts.

The Enduring Pillars of the Subscription Advantage

When analyzing the positives of adopting subscriptions, businesses can gain financial stability through Predictable MRR (Monthly Recurring Revenue). To put it bluntly, venture capital prefers MRR as opposed to unpredictable and volatile revenue streams. In turn, it ensures the company obtains a higher valuation, as it means there is a low risk associated with the business’s health and potential growth. Another benefit to this model is its customer stickiness and LVT (Lifetime Value), as it is easier to maintain clients on a long-term basis (or achieve higher conversions).

This model anticipates customer behaviors that can be influenced by something as simple as not having to manually make a payment for something. Essentially, it is banking on the psychology of how customers are usually unwilling to make a repeat purchase due to them having a moment to consider if they even need a product/service. A subscription is a set-it-and-forget-it kind of commitment, and the payment will be deducted from your bank account before you even have time to hesitate. A subconscious barrier is built against cancelling a subscription, prompting the classic “but what if I need it” argument you make to convince yourself not to cancel.

The Oncoming Tide of “Fatigue” and Churn

There are a few downsides to adopting this model, with the main being subscription fatigue. With the sheer number of digital services and subscription offerings shoved into the face of consumers daily, it has (naturally) become overwhelming. It is estimated that the average American has at least 2.8 streaming services and spends almost double their initial budgeted amount to pay for them. In turn, more users are trying to move away from subscription offers to not only save money, but also declutter their mental checklist of responsibilities. A large part of why customers are currently experiencing this fatigue can be attributed to the battlefield they need to go through to cancel a subscription.

Everyone has fallen victim to wanting to cancel a subscription, but putting it off until later due to “not being in the mood” for the cancellation process. This leads customers to pay for services they do not even use, which is why pressure is being placed on the industry to provide easier cancellation. However, doing this would lead to higher churn rates for businesses, which is not a favorable outcome (and will lead to much pushback from various sectors). Lastly, more customers are also breaking away from this subscription chokehold due to the value erosion caused by price hikes. These platforms tend to remove or limit content, or add additional tiers while simultaneously upping the price, eliminating the initial value offering.

The New Winning Strategies: Adapting to the Modern Consumer

A smarter way for businesses to achieve a winning strategy is to instead focus on modern consumer needs and wants. For one, “freemium” or hybrid model subscriptions (think Discord Nitro or LinkedIn Premium) give customers access to fully functioning free, base versions of their platforms. Although it sounds counterproductive, the business still gets a massive stable pull from free users, and those who buy the premium versions get access to true utility. In addition, businesses could try aiming for a model that solves the current fatigue issue: a unified ecosystem. Amazon Prime is a great instance of how value can be added to a service and make customers hesitant to cancel. If one subscription offered you access to five different platforms, would you even want to cancel it?

Conclusion: The Future is Not Access, It’s Irreplaceable Utility

Ultimately, although the subscription model is not failing, it has reached a point where some change is required. Simple access models like Netflix and Crunchyroll are struggling to bring in new customers due to fatigue and competition. Leaning into the “mature” versions of these subscription models (unified ecosystems and hybrid models) will yield the highest results. Think of it this way: the service needs to be essential and irreplaceable for customers as opposed to a transaction with no value.

Leave a Reply